Key Features

Generate limits of up to 94% of your holding value instantly.

Create positions with 100% of your securities as margin, without providing any upfront cash.

Access and select Shares as Margin for up to 1200+ stocks.

Shares as Margin Calculator

-

Last Traded Price (LTP)₹

-

Haircut%

Against shares worth ₹

Shares as Margin Stock List

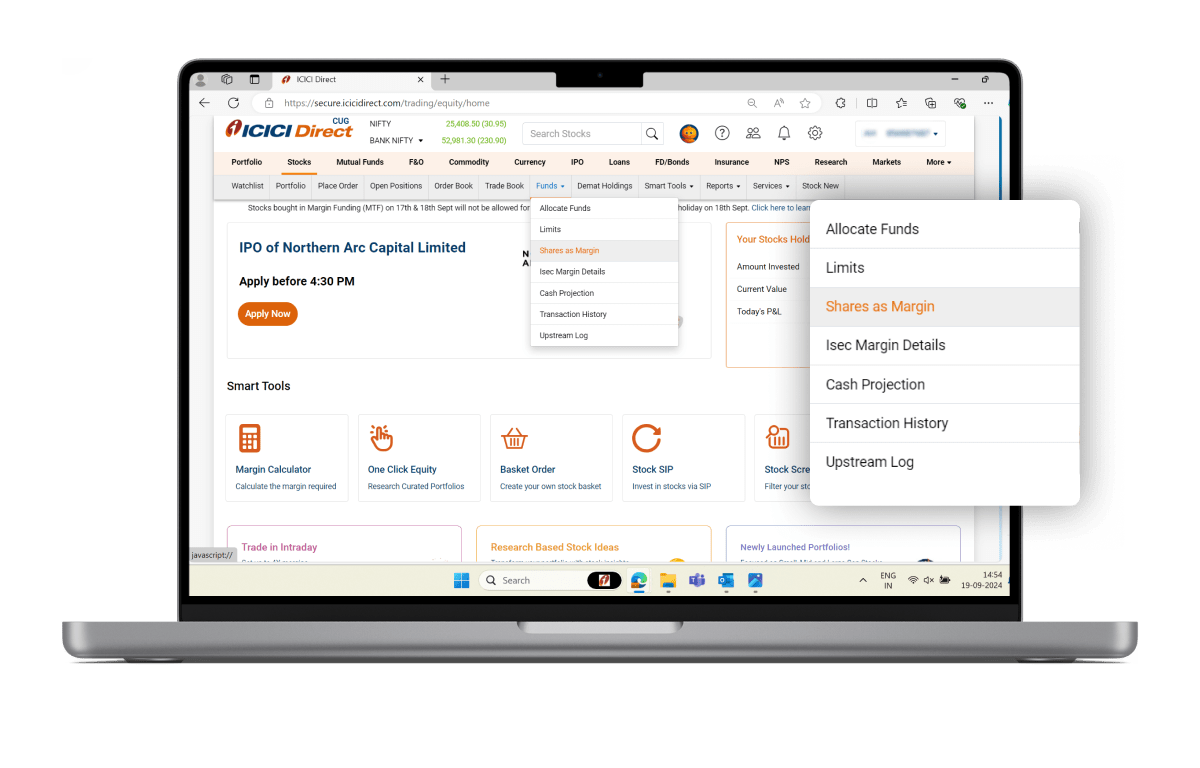

How to create limits in Shares as Margin

Step 1:Visit Shares as Margin

Under Stocks -> Funds -> Shares as Margin

Step 2:Stock Selection

Enter the quantity against the stock which you want to pledge.

Step 3:Select Segment

Chose the segment in which you want to create limits (Equity, F&O, Commodity, Currency). Please note that you can always change the limits to a different segment later on.

Step 4:Confirm Through OTP

Check the tick box and, enter OTP details and click confirm in the Pop up that appears.

Step 5:Receive Limit & Start Trading

Your trading limit will be created instantly which can be observed under "Securities Allocation" in the Limits page (Stocks -> Funds -> Limits).

*The securities are quoted as an example and not as recommendation

Things to note

In case you have both cash and limits in your segment and a buy order is placed, Shares as Margin limits will be blocked first, followed by cash.

You will be charged Rs.29+ GST per security when you pledge/unpledge/invoke your shares.

Whenever a corporate action like Bonus/Split/Merger is announced by a company, the Haircut percentage of the stock may gradually start to increase.

Shares as Margin limits are updated daily based on closing prices and may be revalued during market hours in times of high volatility.

Frequently Asked Questions

What is shares as margin (SAM)?

Shares as Margin allows you to pledge the shares held by you in your Demat account and generate limits against those shares.

-

The limits generated can be used in:

- Margin Orders (MTF, Intraday)

- Futures and Options

- Commodities

What is Haircut in Shares As Margin?

While pledging shares, you get a trading limit after reducing a certain value of your holdings. This reduced value is called haircut and it varies from stock to stock.

For example, if the value of shares pledged is worth Rs.10,000 and the haircut of the stock is 20%. The limits created will be 10,000 – 20%* 10,000 = Rs. 8,000.

How much time it takes to generate margin under SAM?

Margins are created instantly after receiving OTP.

What are the applicable Pledge charges for both Margin Trading and Shares as Margin?

The pledge charges for Shares As Margin and MTF is as follows:

- Charge for Shares As Margin Pledge Creation/ Closure/ Invocation - Rs.29 + GST

- Charge for MTF Pledge Creation/ Closure/ Invocation - Rs.25 + GST

Will my shares as margin funding limits change on a day to day basis?

The value of the limits generated by pledged shares in Shares As Margin depends on the Quantity, Price and Haircut of the stock.

The formula for creation of limits is as follows:

(Quantity of the stock deposited * Price of the stock) * (1 - Haircut% for the stock)

As the price of the stocks varies daily, the corresponding limits that are created by pledging the securities also change.

Generally, the previous day’s closing price is taken as the Valuation Price of the stock. So, if the price of the stock starts to fall, funding limits that are generated by pledging the stock decreases, vice-versa as the price of the stock increases the funding limits are also increased. Limits will also vary due to changes in haircut% of the stock.

Whenever you take positions using Shares As Margin limits and the value of the limits starts to fall. The positions taken using those Shares As Margin limits may get squared off due to lack of sufficient margins.

Therefore, whenever you have taken F&O and Equity positions on the basis of limits arising from Shares As Margin, you are advised to track the prices of stocks and ensure that sufficient margin is always available.